Match LAist.

Chairman Barack Obama shared a different foreclosure-release efforts now he claims may help to 9 million battling people. Early in the day apps have got all essentially failed. But the Union Alabama payday loans package launched today is actually wide plus aggressive than simply early in the day perform. The program commits as much as $275 billion into the authorities financing to save members of their houses. NPR’s John Ydstie is now offering on the plan really works.

JOHN YDSTIE: You can find about three fundamental means people could be aided by this bundle. One involves a simple refinancing to possess people who possess loans had otherwise secured from the regulators-regulated financial giants Fannie mae and you can Freddie Mac. At this time, the problem is you to definitely because of huge declines home based values nationwide, those of us property owners owe more on their mortgage loans than their house can be worth. President Obama said now however loosen up constraints with the Fannie and you will Freddie to make it simple for they so you can re-finance.

BARACK OBAMA: And also the estimated costs so you can taxpayers might possibly be approximately zero. If you’re Fannie and you may Freddie perform located less overall when you look at the repayments, this will be balanced out-by a reduction in defaults and you can property foreclosure.

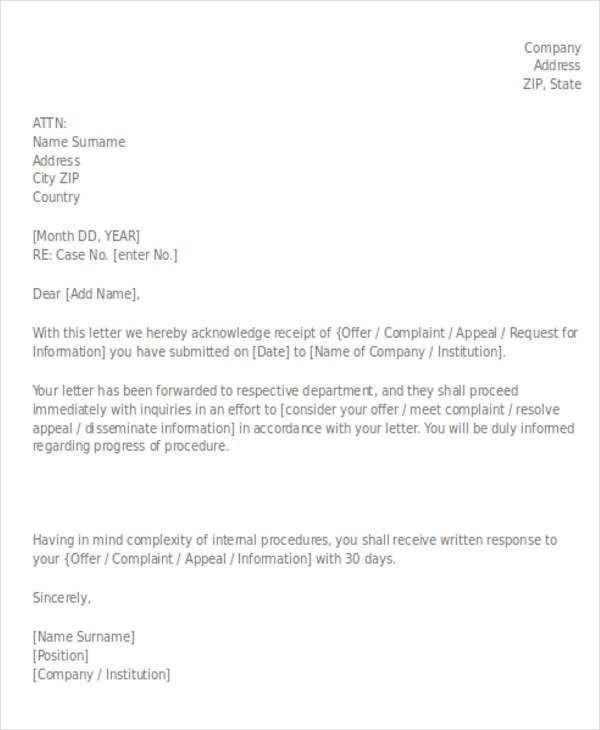

How the Obama Home loan Bundle Works

YDSTIE: But the authorities increase the brand new backstop it is providing to own Fannie and you can Freddie by the $two hundred billion. The new chairman states so it section of the master plan may help cuatro to 5 million home owners remove the monthly mortgage repayments.

ZANDI: The genuine trouble with foreclosure is dependent on finance you to Fannie and Freddie don’t have a lot to do with – the nonconforming markets, subprime fund, a lot of choice-An obligations, particular jumbo fund – which is where all the foreclosures is actually occurring and can exist. Plus they do not benefit from that the main plan.

YDSTIE: But the next part of the new homes save your self bundle is made to help people that have people unique mortgages. As the President Obama explained today, it requires government entities and you will loan providers integrating to attenuate monthly obligations of these residents.

OBAMA: This is what it indicates. In the event the lenders and you will homeowners collaborate, plus the bank believes to offer cost that debtor can also be manage, next we will compensate a portion of the pit anywhere between just what dated money was in fact and you may precisely what the the new money might possibly be.

YDSTIE: Also, government entities would offer incentives in order to financial servicers, along with an effective thousand cash for every single modified loan. The program would-be voluntary, in the event any standard bank is to need save yourself funds from the federal government down the road was necessary to take part. The chairman projected three to four million property owners might possibly be assisted by this part of the package. Draw Zandi believes this part of the container would depend excessive on the attract-rates reductions. The guy argues that considering just how much home prices has actually fallen, cutting dominating to the financing is needed to halt property foreclosure rapidly.

SUSAN WACHTER: The evidence around is that when you are prominent prevention is important, what’s most secret ‘s the mortgage repayment. That is what needs to be quicker. Whenever one protection will come as a result of attention reductions otherwise dominating reductions – bottom line, its what individuals shell out that must definitely be reasonable.

YDSTIE: Wachter says overall, she believes this is an excellent package and certainly will has a keen impression. The final biggest consider President Obama’s casing save yourself plan is based into passing of bankruptcy proceeding legislation swinging through the Congress. It will enable it to be bankruptcy proceeding evaluator to jot down the value of the loan due because of the a citizen to the current property value our home. And to produce an idea to own people to carry on making repayments. John Ydstie, NPR Information, Washington. Transcript provided with NPR, Copyright laws NPR.