To shop for a property – whether it’s the first otherwise last – try an appealing date. You could browse online and trip the appearance and neighborhoods one attention you. You might go after your own agenda and then make a deal whenever it’s wise. Really, as long as you keeps an excellent pre-approval letter available.

Financial pre-acceptance try a critical first rung on the ladder at your home to find procedure. It permits one see your budget and informs the vendor you have money accessible to money the house get.

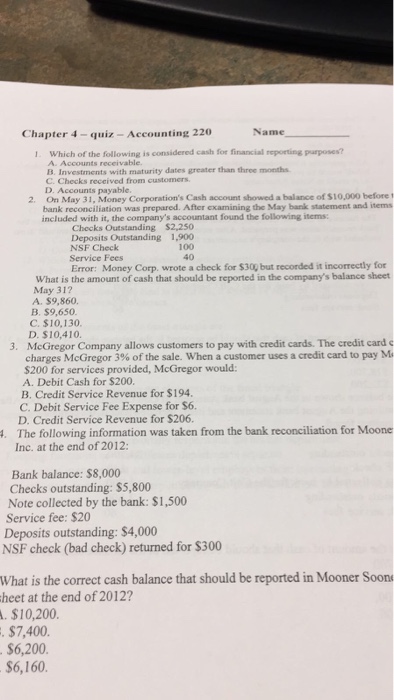

Why does mortgage pre-approval really works?

To locate pre-acknowledged having a mortgage, you ought to focus on a loan provider to ensure your financial pointers. You’ll fill in documents for example paystubs, proof property, employment confirmation, etcetera. On looking at such as for instance records, the lender will likely then offer a loan guess telling you if or not you are pre-accepted.

In this techniques, the lending company will also manage a card remove. The credit pull assists them learn whenever you are most recent into loans repayments and just how much you bring.

Does pre-approval harm my credit?

Getting pre-acknowledged to own home financing allows the lender to pull your own credit declaration from the about three chief credit bureaus – Experian, TransUnion, and you will Equifax.

Home loan shopping can be recognized as a confident monetary disperse by credit rating habits, and you may multiple borrowing from the bank checks from mortgage lenders within this an excellent fourteen so you can a great forty-five-day windows will end up being submitted as the a single inquiry. This enables customers to search up to and get mortgage pre-approval out of multiple loan providers without its credit history providing a significant hit.

Once you apply for the brand new credit – eg a charge card, home loan, otherwise auto loan – your invest in a hard inquiry. Tough concerns alert the top credit bureaus you are trying to get financing otherwise personal line of credit.

If your credit has been analyzed of the a property manager otherwise insurance coverage business, these are generally simply evaluating your own report unlike loaning you money. Thus, it is felt a softer query. Delicate issues dont affect your own rating neither show up on your credit score.

Difficult borrowing questions tend to have a minor influence on your own credit ratings. We offer good five-point reduced total of your score due to the fact lenders feedback debt stability. Thus, there’s no significant harm to your own credit.

Remember, once you may be ready to initiate selecting a home loan, aim to take action in this an effective forty-five-day time physique. Following all the borrowing from the bank inquiries generated will appear as one inquiry on your credit file.

The length of time do questions stay on your credit report?

Difficult inquiries may stick to your credit history for 2 years. Regardless if, centered on Equifax, they often merely apply to the fico scores for 1 seasons.

Do refinancing affect my credit rating?

Refinancing the home loan are the same sense to help you home loan pre-approval in that a loan provider (or loan providers) would need to create a challenging inquiry borrowing from the bank pull. It is very important remain within this one same forty-five-day window you aren’t negatively impacting the get.

It is additionally vital to know that refinancing their mortgage too frequently can result in a very tall lose during the rating. You ought to make sure you will be talking-to a skilled financial agent being know every re-finance benefits and you can borrowing score affects.

Are my credit history strong enough to have mortgage pre-approval?

Ahead of seeking home loan pre-recognition, check your credit to understand what are said on the borrowing declaration. Individuals are entitled to a totally free content of their credit history all of the one year. Only visit annualcreditreport.

If you notice your credit payday loan Austin rating might use some works, here are some our overview of Ways to Cleanup The Credit.